Oil Prices Surge News: Impact of Israel Attack on Global Energy Markets

By Ryan Dezember

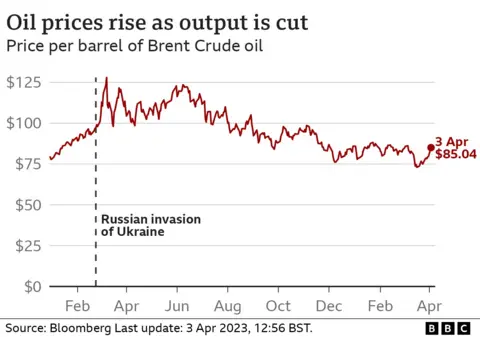

U.S. crude oil prices have surged over 8%, climbing above $73 a barrel. This marks the highest level since February, before President Trump’s tariffs announcement in April had energy traders worried about slower economic growth and reduced fuel demand. Most importantly, the recent attack by Israel has significantly impacted the oil market, contributing to the crude oil price increase. 📈

The Impact of Israel Attack on Oil Prices

The geopolitical tension resulting from the attack has led to immediate ripples in the global oil market. Consequently, traders are now uncertain about the stability of oil supply and demand. Furthermore, concerns are mounting regarding potential disruptions to oil production in the region. These disruptions could exacerbate the crude oil price increase, affecting both the local and international markets. For ongoing updates and analysis on commodities markets, including oil, Reuters offers timely insights.

Crude Oil Price Increase and the Iran Nuclear Deal

Earlier this spring, there was some optimism that an Iran nuclear deal might lead to eased sanctions, allowing more Iranian oil to enter the market. This availability could have kept prices steady. However, traders now seem doubtful that the U.S. will lift these restrictions anytime soon. As a result, the anticipated Iran nuclear deal oil effects are not materializing as expected.

U.S. Oil Market Analysis and Broader Implications

Because of this uncertainty, the U.S. oil market is experiencing volatility. Therefore, understanding the broader implications of these changes is crucial. The U.S. Energy Information Administration (EIA) provides comprehensive data on energy production, consumption, and pricing trends. This resource can help readers grasp the context of current oil price fluctuations.

Besides that, global business news platforms like BBC News offer insights into the oil market and geopolitical events. These insights enhance understanding of the international implications of rising oil prices. 🌍

In conclusion, the sharp rise in oil prices underscores the complex interplay of geopolitical events, market expectations, and policy decisions. Staying informed through reliable sources is essential for navigating this dynamic landscape.